Once adjusting entries have been made, closing entries are used to reset temporary accounts. You might be asking yourself, “is the Income Summary account even necessary? ” Could we just close out revenues guide to how to do marketing research and expenses directly into retained earnings and not have this extra temporary account? We could do this, but by having the Income Summary account, you get a balance for net income a second time.

What Are Closing Entries?

- The Printing Plusadjusted trial balance for January 31, 2019, is presented inFigure 5.4.

- When you compare the retained earnings ledger (T-account) to the statement of retained earnings, the figures must match.

- For example, closing an income summary involves transferring its balance to retained earnings.

- Remember, when using the double-entry system, you must always debit one account and credit another for the same amount.

Let’s say your business wants to create month-end closing entries. During the accounting period, you earned $5,000 in revenue and had $2,500 in expenses. Essentially, all opening entries of a new fiscal year are the exact entries and figures of the previous period’s closing entries. Therefore, the beginning balance of these accounts can be taken from the previous period closing account balances. Journal entries are an essential part of the accounting process for any business. Whether your company uses single or double-entry accounting, you will need to ensure the proper method of opening and closing journal entries happens at the designated time.

How Highradius Can Help You Streamline Your Accounting Management

This is the same figure found on the statement ofretained earnings. Notice that the balances in interest revenue and service revenueare now zero and are ready to accumulate revenues in the nextperiod. The Income Summary account has a credit balance of $10,240(the revenue sum). Now, all the temporary accounts have their respective figures allocated, showcasing the revenue the bakery has generated, the expenses it has incurred, and the dividends declared throughout the past year. Notice that the balances in interest revenue and service revenue are now zero and are ready to accumulate revenues in the next period.

Unit 4: Completion of the Accounting Cycle

These accounts are temporary because they keep their balances during the current accounting period and are set back to zero when the period ends. Revenue and expense accounts are closed to Income Summary, and Income Summary and Dividends are closed to the permanent account, Retained Earnings. It is permanent because it is not closed at the end of each accounting period. At the start of the new accounting period, the closing balance from the previous accounting period is brought forward and becomes the new opening balance on the account.

Frasker Corp. Closing Entries

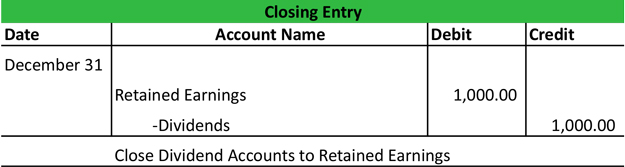

The purpose of closing entries is to merge your accounts so you can determine your retained earnings. Retained earnings represent the amount your business owns after paying expenses and dividends for a specific time period. As the drawings account is a contra equity account and not an expense account, it is closed to the capital account and not the income summary or retained earnings account. After the closing journal entry, the balance on the dividend account is zero, and the retained earnings account has been reduced by 200.

Closing Journal Entries in Accounting Ledgers

Closing entries, also called closing journal entries, are entries made at the end of an accounting period to zero out all temporary accounts and transfer their balances to permanent accounts. In other words, the temporary accounts are closed or reset at the end of the year. Closing entries are entries used to shift balances from temporary to permanent accounts at the end of an accounting period. These journal entries condense your accounts so you can determine your retained earnings, or the amount your business has after paying expenses and dividends.

The fourth entry requires Dividends to close to the Retained Earnings account. Remember from your past studies that dividends are not expenses, such as salaries paid to your employees or staff. Instead, declaring and paying dividends is a method utilized by corporations to return part of the profits generated by the company to the owners of the company—in this case, its shareholders.

Now, if you’re new to accounting, you probably have a ton of questions. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting.

This account helps businesses shift their revenue and expense balances from the temporary accounts into the permanent account known as retained earnings found on the balance sheet. The accounting cycle involves several steps to manage and report financial data, starting with recording transactions and ending with preparing financial statements. These entries transfer balances from temporary accounts—such as revenues, expenses, and dividends—into permanent accounts like retained earnings. The balance in dividends, revenues and expenses would all be zero leaving only the permanent accounts for a post closing trial balance. The trial balance shows the ending balances of all asset, liability and equity accounts remaining.

To get a zero balance in an expense account, the entry will show a credit to expenses and a debit to Income Summary. Printing Plus has $100 of supplies expense, $75 of depreciation expense–equipment, $5,100 of salaries expense, and $300 of utility expense, each with a debit balance on the adjusted trial balance. The closing entry will credit Supplies Expense, Depreciation Expense–Equipment, Salaries Expense, and Utility Expense, and debit Income Summary. Closing entries are journal entries made at the end of an accounting period, that transfer temporary account balances into a permanent account. Since dividend and withdrawal accounts are not income statement accounts, they do not typically use the income summary account. These accounts are closed directly to retained earnings by recording a credit to the dividend account and a debit to retained earnings.