Posts

Credits are permitted on condition that you receive effectively connected income. For those who did not have a keen SSN (or ITIN) provided to the otherwise before the due date of one’s 2024 get back (along with extensions), you cannot claim the kid income tax borrowing on the either your own unique or an amended 2024 get back. You can also qualify for so it borrowing from the bank (labeled as the new saver’s borrowing) for those who made qualified benefits to a manager-paid senior years package or to an IRA inside the 2024. To learn more about the standards in order to allege the financing, discover Bar. When you’re a citizen alien, a qualifying centered has the being qualified man or qualifying relative.

Once we could possibly get earn profits out of names noted on this site, all of our reviewers’ views will always her and so are perhaps not swayed by economic consider in any manner. All of our reviewers opinion the new labels from the player’s perspective and present their viewpoints, you to definitely are still unedited. This enables us to publish purpose, objective and you may true analysis. Both discover short term house and you can long lasting house, there is no minimum money demands. Short term house provides the authority to live and you may work with Paraguay, and to getting susceptible to Paraguayan taxation for a few decades.

Exactly what do a property owner subtract away from protection deposits?: casino guts login

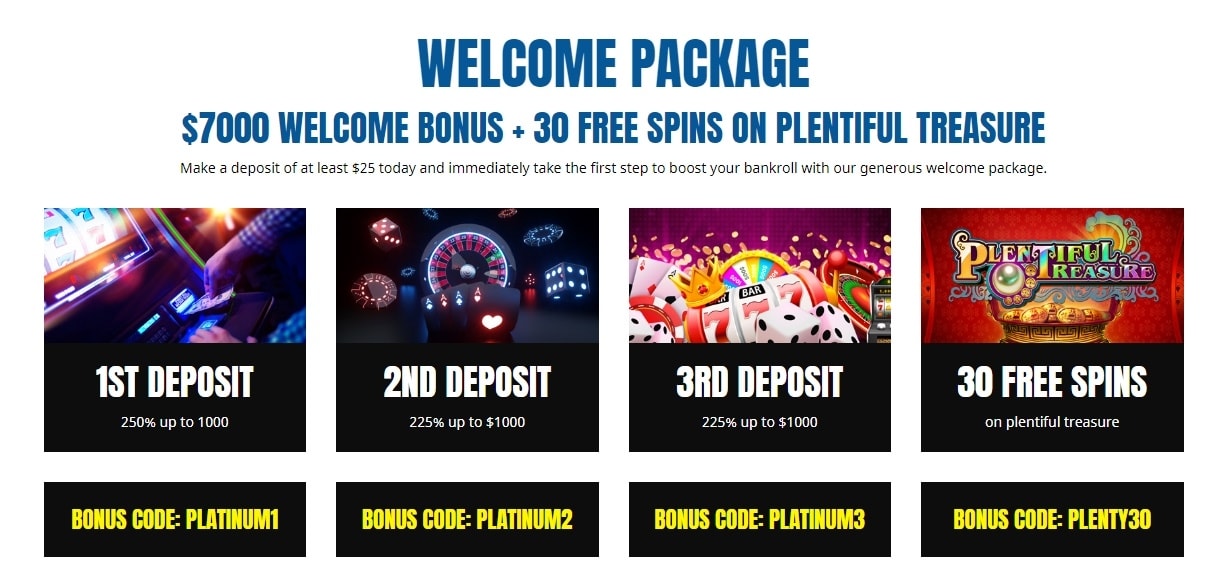

It’s very essential read your casino’s conditions and terms before registering otherwise making in initial deposit, you know precisely what you are getting into and you may select the best local casino to you personally. If the local casino features a bonus available that comes with 100 percent free revolves, We wear’t understand the reasons why your shouldn’t be capable of geting her or him, providing you meet with the casino’s requirements. As you is content it checklist general, i encourage paying attention to your own regional market. If you know for an undeniable fact that their hardwood man fees $step 1,one hundred thousand for each place, create one recognized to the renter. The greater precise you can be today, the brand new fewer amazed renters you’ll manage later.

$5 Minimum Put Casino NZ – Deposit 5 get 100 free revolves

Your own occupant is responsible for a full cost of casino guts login outstanding rent and you will injuries, even when its deposit isn’t enough. Always, a month’s lease is actually basic, but in highest-consult parts, you are in a position to request much more. The ideal defense deposit count depends on your leasing’s area and you will state laws. Either, renters you will ask to use element of the put for rental, brief solutions, or even security unpaid costs when they’re quick for the cash. Getting the new target the most important shelter put regulations that you have to go after.

The following discussions will help you know if earnings you get inside income tax year is effectively regarding an excellent U.S. exchange otherwise team and just how it’s taxed. So it exclusion does not apply to settlement to have functions performed to your foreign flights. The decision to be addressed because the a resident alien try suspended for the taxation 12 months (after the tax year you have made the choice) in the event the neither mate try a good You.S. resident otherwise resident alien when inside the income tax seasons. It indicates for each and every mate must file an alternative return while the an excellent nonresident alien regarding seasons if the either match the brand new submitting criteria to own nonresident aliens discussed inside the a bankruptcy proceeding. Nonresident alien students from Barbados and Jamaica, as well as trainees away from Jamaica, can get qualify for an enthusiastic election getting treated while the a citizen alien to have U.S. tax objectives underneath the You.S. tax treaties which have those individuals regions. For individuals who qualify for that it election, you possibly can make it by processing a form 1040 and you will tying a finalized election statement on the get back.

Platforms such Qira provide significant advantages to one another people and you can property professionals. Residents get to keep more cash within pouches, and you will possessions executives don’t need assume any extra chance—Qira protects it in their eyes. Assets professionals can charge to possess defense dumps or perhaps the very first week’s rent initial, but they might no prolonged charge a rental software percentage. Also they are not allowed in order to charges flow-within the fees otherwise circulate-away fees.

So you can allege the brand new deduction, enter a good deduction of $step three,100000 or reduced online 15b or a great deduction away from more than simply $step 3,one hundred thousand on the internet 15a. If your fiduciary elects to take the credit rather than the deduction, it has to make use of the Ca income tax speed, range from the borrowing amount to the complete online 33, Total Repayments. Left of the full, make “IRC 1341” and the quantity of the financing. Go into the total taxable earnings maybe not claimed elsewhere on the Front step one. Look at the box whether it Form 541 is being recorded while the a protective allege to have reimburse.

If you amend Form 1040-NR or file the correct return, go into “Amended” across the best, and you will attach the newest remedied return (Function 1040, 1040-SR, or 1040-NR) to form 1040-X. Typically, an amended get back claiming a refund must be submitted within this 3 many years on the time their return is submitted or within this 2 many years ever since the brand new income tax is actually paid off, any try after. Money recorded before final deadline is recognized as so you can were recorded on the due date. When you fill out their taxation return, bring special care to go into a proper quantity of people income tax withheld revealed on your own suggestions data files. The following dining table lists some of the more prevalent information data and reveals finding the amount of income tax withheld. To claim the new use credit, file Form 8839 with your Setting 1040-NR.

Bank checking account helps you manage your cash in versatile means. Start with Financial Smartly Examining to help you discover advantages and additional advantages since your stability grow. Only search up-and to get the set of an informed $5 put casinos in the Canada. Our very own members just who sign in during the Jackpot City is found a welcome added bonus as high as $step one,600.